Bringing

transparency and

efficiency to post-trade

Delivering real efficiencies that transform your operations in the digital era.

Optimize your operationsProven innovators

in post-trade automation

Re-engineering post-trade processes

With innovative payables and receivables automation software and deep expertise in managing complex workflows, calculations, and data sets, we simplify your settlement, billing and invoicing activities, helping you unlock new value in post-trade operations, cut through costs and meet regulatory requirements.

7

of the top ten global investment

banks trust us to provide their

regulatory technology

20+

years of experience in delivering

post-trade automation solutions

for capital markets

Once your trade is executed, our job begins

Take control of settlement, billing and invoicing activities across your post-trade workflows.

Solutions overviewTrade Expense Management

VIEW SOLUTION

Asset Servicing Claims Management

VIEW SOLUTION

Transaction Tax Management

VIEW SOLUTION

CSA and Research Billing

VIEW SOLUTION

CSDR Penalties Processing

VIEW SOLUTION

Trade Tracking and Exception Management for T+1

VIEW SOLUTION

Understand your post-trade costs and what drives them

Our powerful, rules-based automation solutions validate, calculate, settle, and communicate all your trade-related fees, claims, taxes, and penalties. Providing full transparency of costs and enabling you to determine the correct action on any payment, we help facilitate balance sheet optimization and regulatory compliance.

Discover our solutionsMeritsoft

– a proven partner

We’ve been delivering post-trade process automation to many of the leading global financial institutions for two decades. They trust our solutions, and the experts who deliver them, to help transform their operations, improve efficiency, and reduce their regulatory cost of capital.

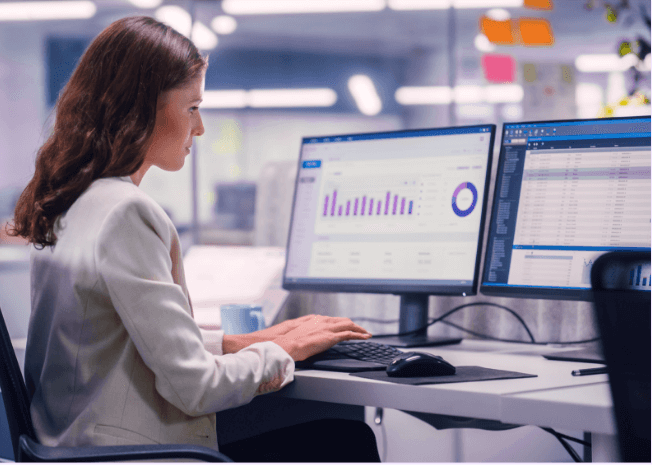

Find out howEngineered by experts, driven by finance

Our technology platform supports a product suite optimized for both on-premise and cloud deployment with scalability built in to meet future demands. Graphical, rules-driven decision trees embedded in a state-of-the-art UI ensure a truly intuitive user experience.

Learn moreSpeak to one

of our team

Our dedicated team of experts really understand

your operational challenges and the solutions.